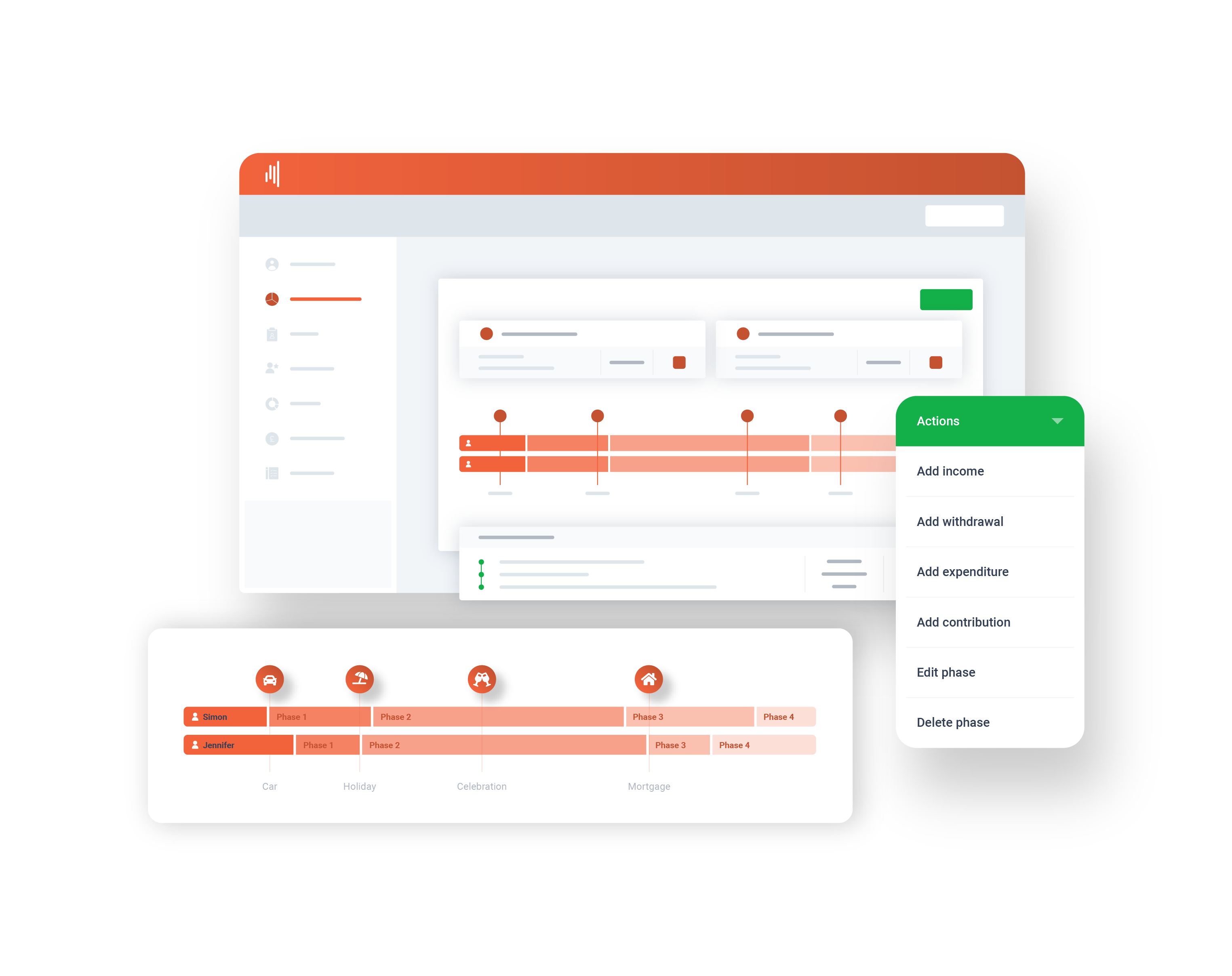

The heartbeat of your financial planning technology, making your firm more efficient and enabled to service more clients.

Use your data seamlessly and avoid rekeying across one system integrated with your back office and platforms.

Engage with clients, inviting them into the planning process. Empower them to contribute, when and how it suits them.

Equip your teams to collaborate effectively, efficiently picking up where a colleague has left off.

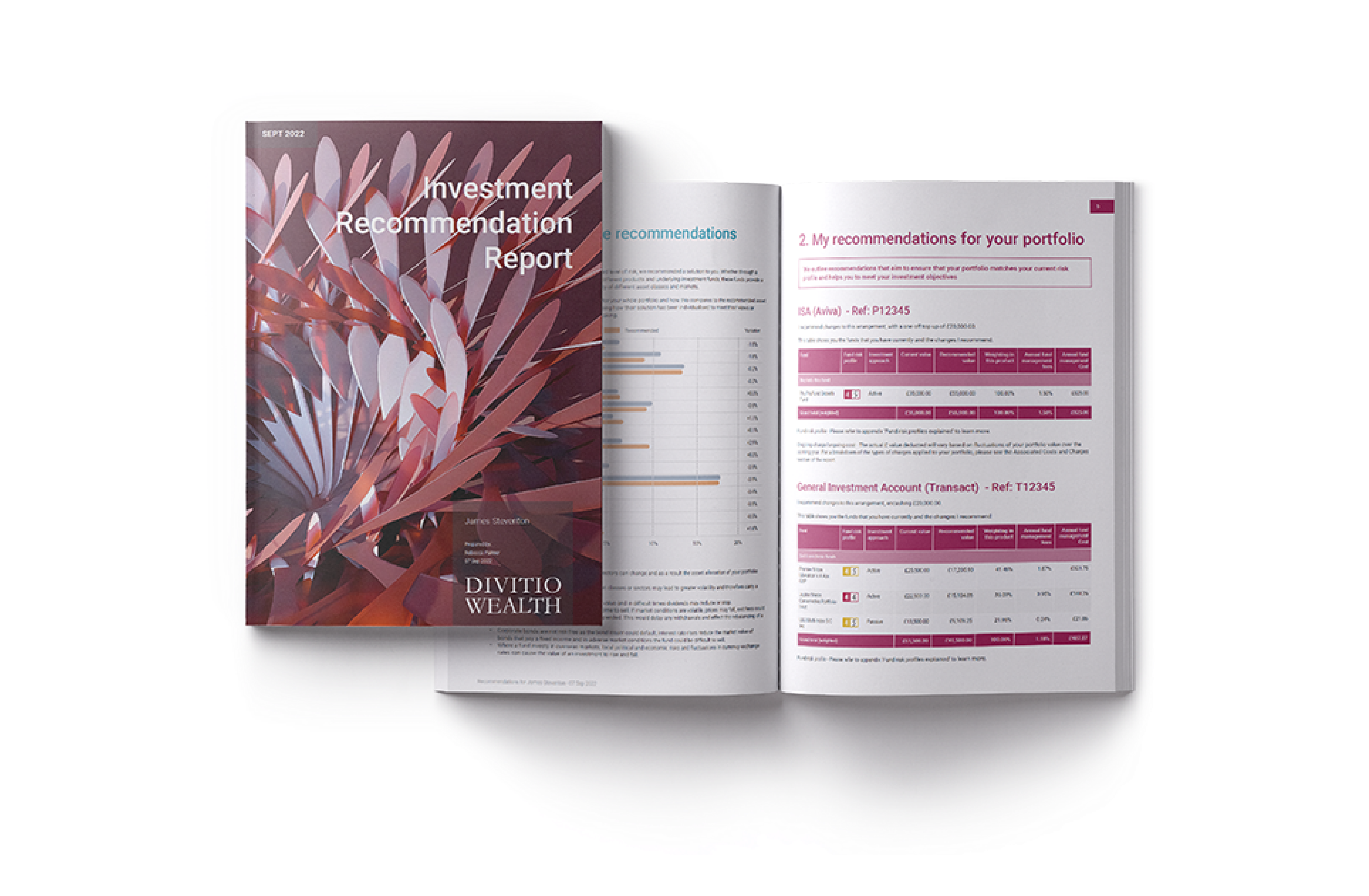

Demonstrate your firm’s value, through market-leading client profiling; compelling annual reviews; powerful cash flow plans; and suitable recommendations at the touch of a button.